Wanna make a difference in the lives of those less fortunate?

Tired of charities that lie about how much of the proceeds actually go to the cause?

Prefer to use your money to positively encourage those with potential rather than enable those without?

Then you might just love Kiva.

Kiva Review

Kiva is a service that allows you to loan money to worthy causes around the globe.

Just say a woman with four kids in Uganda is feeling entrepreneurial and wants to start a business selling woven fabrics.

She’s got a few start-up costs but doesn’t have the disposable income to invest into the business.

She can’t get a loan form the bank because… well, Uganda.

We’re very privileged in the West because if we have a viable business idea that shows promise of return a bank will take a risk on us and give us a loan. It’s simply not like that in most third world countries.

So where does this woman go?

Or just say a father and husband in Nigeria needs a loan to help put his child through medical school.

A worthy cause, but who is going to help fund that?

Or maybe a family in Guatemala need money to improve their chicken farming business. Again, their options are going to be limited.

That’s where you and I and Kiva come in.

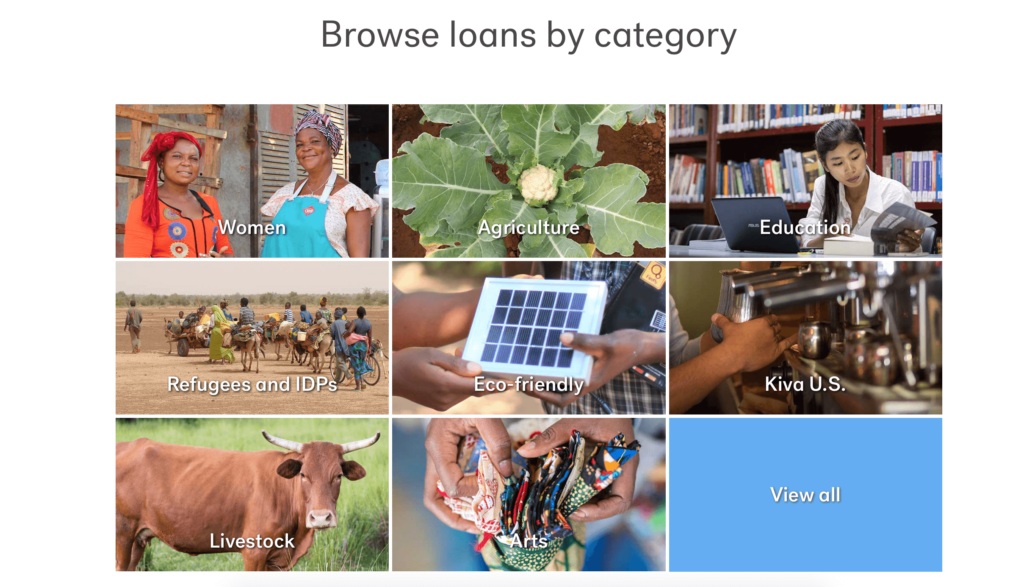

Scroll through Kiva and you’ll see a bunch of worthy causes broken down by categories like:

- Women

- Agriculture

- Education

- Refugees

- Eco-friendly

- Livestock

- Arts

When I first got involved I saw the following needs that stood out to me:

- A man from Tajikistan needed help paying his son’s medical university tuition fees abroad

- A young woman from Georgia needed help paying her tuition fees at a maritime academy

- A woman from Lebanon needed help paying for her two children to go through kindergarten and grade 2

One needed $500, another needed just over $1,000, and another needed over $2,000.

I helped them hit their goals.

No, I didn’t drop a couple grand on these people.

I pledged the minimum loan amount, which is $25, and 20-50 other lenders chipped in to help these people reach their goals.

Some of these people had history of taking loans from Kiva before and had fully repaid them.

Regardless, Kiva claims a 96.8% repayment rate.

That’s the exciting thing here.

This is not a donation. It’s not charity.

You’re lending money to what you believe are worthy causes and you will be paid back.

You could then, of course, keep the loan money in circulation if you wish and build up a portfolio of people you’ve helped.

I love charity work and have had a strong philanthropic streak for years, but one thing that often niggled me about charity was the idea that you might not actually be helping.

Kiva is different.

You are helping people who have a strong direction and they are incentivised to make a success of their endeavours because they have to repay the loans.

Who would do better in school?

- The young person who had tuition money thrown at them with no expectation of paying it back?

- Or the young person who was given a loan to go towards graduating and getting a great career?

It’s a mindset thing.

The people who ask for loans rather than hand-outs and charity typically have a strong sense of pride, mission, drive, and work-ethic.

You’ll see inspiring men and women on Kiva who start an agricultural business in Kenya that then takes off.

So they repay the loan, reinvest, and often they’ll ask for another loan so they can expand and improve.

You’ll see young people from war-torn nations who are enrolled in their second or third degree.

I love that.

And I love the fact that we can play a small part in giving people those kinds of opportunities.

Another thing I love is the idea of building a loan portfolio according to a theme that inspires you.

Of course, you could just give your loans indiscriminately to whatever cause you like, but most people will have a certain hot button topic that gets them excited.

Some people will love the idea of funding women.

Others will be excited by the eco-friendly endeavours.

For me personally, I’m going to concentrate on building a loan portfolio that is mainly comprised of helping people with their education.

As you’ll know if you’ve read anything else on this website, education means a lot for me. And I was blessed with great educational opportunities, ones people from third world countries would do anything for. So this is something that moves me enough to loan.

If that excites you, check out Kiva.

Have a browse through and see what inspires you.

If you follow this link and you’re a first time loaner you’ll get a $25 credit to hand out.

I get nothing for referring Kiva. I simply think they’re a wonderful company. I’m still new to using them, but am excited to keep going.

Let me know what causes compelled you to lend!

Check out Kiva here.